Driving our assets on a NET ZERO CARBON trajectory

Our Climate Strategy

Our action plan:

1. Decarbonising our property portfolio

2. Monitoring & assessing our climate strategy

1. Decarbonising our property portfolio

2. Monitoring & assessing our climate strategy

1. Decarbonising our property portfolio

2. MONITORING & ASSESSING OUR CLIMATE TRAJECTORY

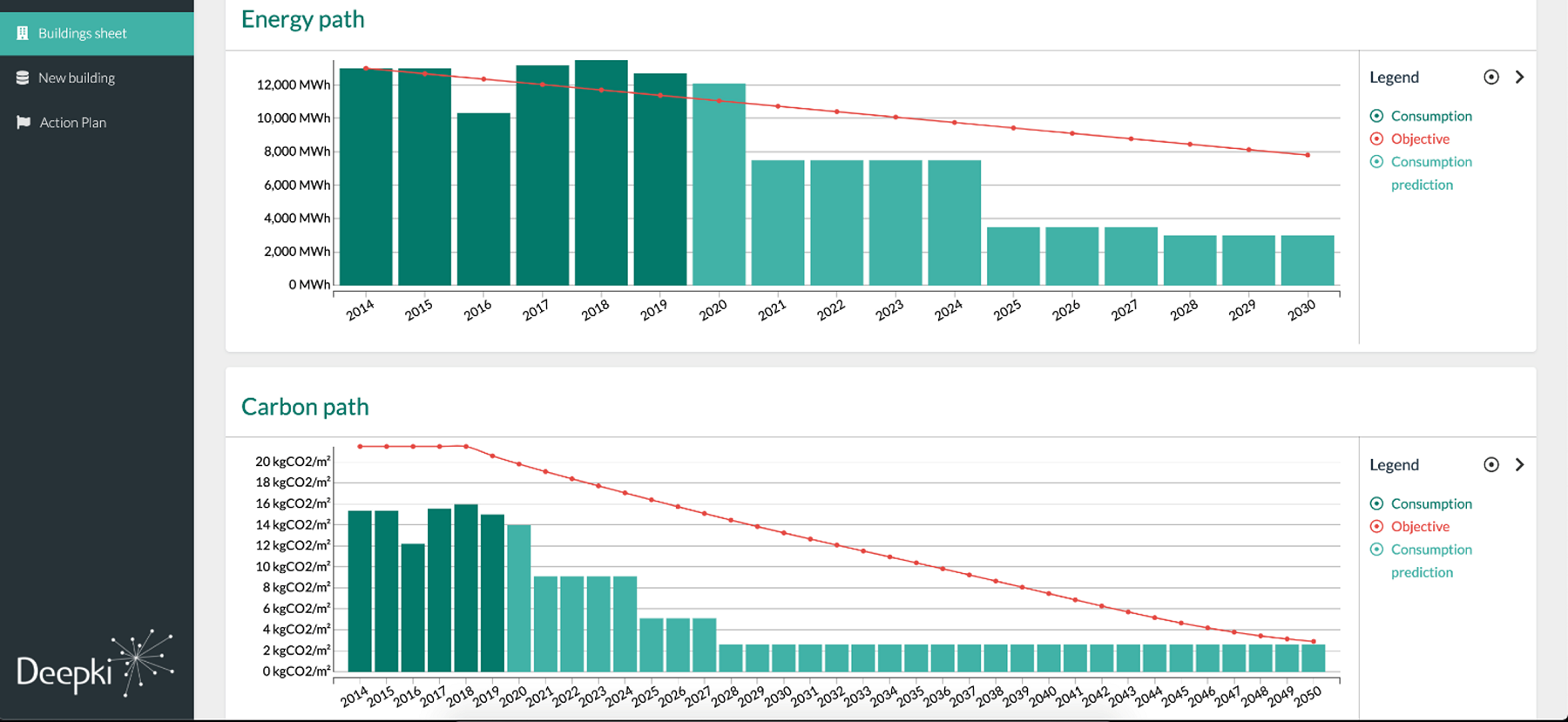

The environmental criteria of the real estate portfolio are managed using various management tools that enable the centralisation, sharing and analysis of building data (energy consumption, water, building usage, equipment condition, etc.) in order to implement the necessary actions.

Our teams define specific action plans for each building, in conjunction with the stakeholders, primarily the property managers and tenants.

Case study

We partner with Deepki, an envrionmental data management and due diligence company.

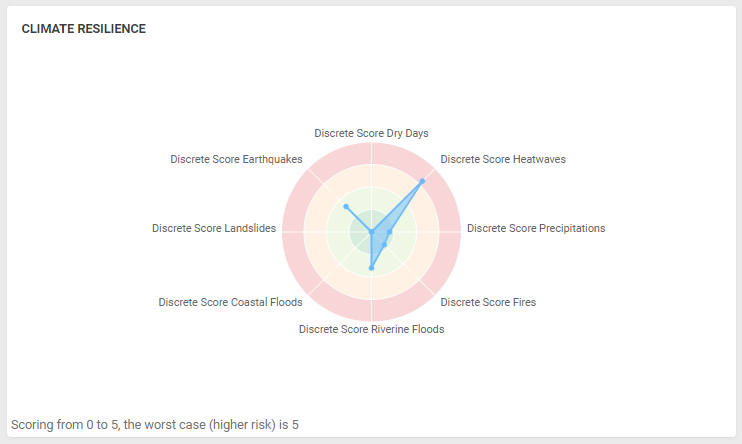

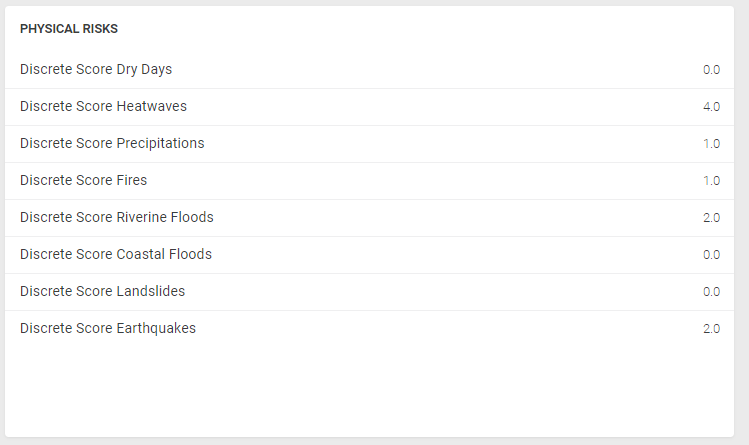

2.2 Sustainability risk mapping

The sustainability risk map analyses the exposure of Primonial REIM's assets to the main climate risks :

- Define an action plan on common major risks

- Identify the most exposed assets to define a specific action plan.

- Review the list of trade-offs for assets exposed to a proven risk that are difficult to adapt.

et Firefox

et Firefox